The Nature of Bitcoin

Bitcoin is a “risk off” asset, offering unparalleled security through its decentralized, immutable blockchain, free from human control.

Perception of Risk

Bitcoin’s price swings fuel FUD – fear, uncertainty and doubt – but volatility is decreasing as BTC matures, with global adoption stabilizing fluctuations. Though there are still waves on the surface, the water is deeper now. People’s risk perception often confuses market dynamics with the blockchain’s flawless operation.

Human Failures

Scandals highlight human flaws, not Bitcoin’s protocol. Mt. Gox’s 2014 exchange hack stemmed from poor security by operators. FTX’s Bankman-Fried fraud involved executive misconduct and centralized custody abuses. SVB’s collapse exposed traditional banking risks like rate mismatches. These failures underscore vulnerabilities in people and systems, not the Bitcoin blockchain.

Distinction: People vs. Blockchain

The blockchain is tamper-proof code; faults arises from human intermediaries like exchanges and custodians. Self-custody eliminates this risk.

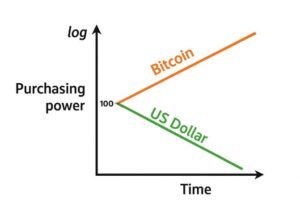

Misplaced Faith In the Old Paradigm

Humans misconceive risk, attributing it to Bitcoin rather than the bankrupt, centralized system. To bitcoiners, having zero bitcoin is crazy. The risk is in NOT owning it. The risk is in blind faith in a dying paradigm.