The Nature of Money

What is money? Is it paper dollars? It has been everything from seashells to gold to what it is today – digits in a ledger, and paper that is freely printable. Gold is better than seashells since it was more limited, but paper is worse than gold because there is truly no limit to the amount that can be printed.

Scarcity

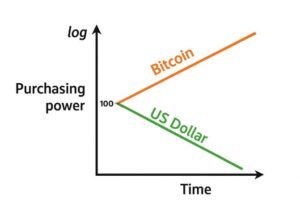

Reason number one that Bitcoin fixes money: It is the only monetary instrument that is absolutely scarce. There are about 20 Million coins that have been created. 21 Million coins is all that will ever exist. About three coins are created every ten minutes and that will continually decrease until the last coin is mined. At what point will bitcoiners refuse to sell?

Money Creation Today

In the present system, money is created out of thin air as debt. A person agrees to pay back a bank loan of $500k, the bank creates that number on a balance sheet and then leverages that “money” at 19 to 1. This means that nearly ten million dollars was created from that one promise; resulting in perpetually higher prices, and giving total control to banks. After all, you don’t own the property, they do. The amount of money they control is ever growing, and inflation ever accelerates.

The Slog of Work

Where does that leave us? Our kids can’t afford to buy a house, real inflation is much higher than reported, and, for many, there’s no way to earn enough in an era of ballooning debt and a quickly depreciating dollar. We are left to paddle against the current.

The Capture of Abundance

Bitcoin gives money back to the people. Why? It is beyond the system’s control. Bankers don’t know how to deal with Bitcoin because it doesn’t behave in the way that they are accustomed. They fear that the abundance they have captured will now be transferred back to the people.

Toppling the Monetary Tower of Babel

In the past year, Wall Street financiers have built a derivatives complex to try to leverage and control Bitcoin. In derivatives, risk is managed by taking a position which bets against the main position. The problem is that you can’t create Bitcoin on a balance sheet because each coin is accounted for. There is no way to verify the gold in the London Bullion Market, but Bitcoin is uniquely transparent. Right now, the world’s financiers are building a tower of leveraged risk that Bitcoin will topple in an inevitable short squeeze when the bill comes due. This will create a buying frenzy for Bitcoin the likes of which we’ve never seen. The wealth of the world will be transferred from the central banks, and also stock and bond portfolios, to the decentralized network of people and institutions that hold Bitcoin.

And the Meek Shall Inherit the Earth

It is difficult for us who live in the fiat world of debt bubbles to understand what kind of world will proceed from such a transfer. Deflation will rule and prices will continually drop, meaning value will continually increase over time. Though the pain in the short to medium term could be severe, the world that will emerge will be one of ultimate abundance in the first truly free market. This will be a whole new paradigm of human existence in which the nature of time itself, and how people structure their lives, will change.