Big Banks Are Speaking Up

August, 2025 – The Bank of International Settlements (BIS – the central bank of central banks) released guidance this week regarding crypto, AML approaches (Anti Money Laundering), and KYC (Know Your Client protocol.) An AML compliance score based on the likelihood of illicit blockchain activity is proposed in order to track funds and ensure that no client given a low enough score can transact in the banking system.

The Trend

Here is an attempt to start tracking blockchain transactions internationally and ultimately to make a record of who owns what and who sold what to whom.

After all, we can’t have criminals laundering money, can we?

What it Means Today

People say, “What do you have to hide?” And today there is little concern an AML approach could become oppressive. Many of us buy bitcoin on Coinbase, and they require our KYC info, and so our bitcoin data is out there.

So?

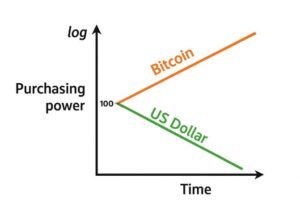

It’s true that right now it doesn’t seem to matter that banks are vying for power over bitcoiners. But we are living in unprecedented times. Stocks are at all-time highs; housing and rents through the roof; gold, Bitcoin at all-time highs; debt levels are at all-time highs and accelerating.

What’s AI Got To Do With It?

AI will quickly categorize and quantify everything over the next couple of years. Bitcoin is threatening the global banking system because it is out of the central bankers control. AI offers a way to have complete oversight, in theory.

Can the Debt Bubble Continue?

In a crisis, what could be done? What if, in a bank collapse, massive pools of capital flow into Bitcoin, as it could? Who would blame them if they came for bitcoiners? Let’s not forget that FDR confiscated all the gold in 1934, or that Nixon confiscated the gold standard itself in 1971. This is the same bubble we are still in, and we are living through the transition from it.

We Still Have Rights

Right now, you have a right to transact privately and offline. You have a right to set up a Bitcoin node and transact directly on the blockchain. You have a right to act to protect your property. Time will tell if those rights persist. But Bitcoin will remain unkillable. We are at the very beginning. At the heart of the debate is the right to private property and whether anyone, foreign or domestic, has the right to try and strip you of it.